Accounting for Non-Profits and Charities

Accounting for non-profits and charity organizations is somewhat different from accounting for the typical for-profit business. Nonprofit organizations mostly rely on donations and grants to finance activities. They are required to submit earnings and expenses similar to for-profit organizations. The aim of preparing financial statements is to ensure full financial transparency for the donors and other stakeholders.

In this blog post, we will explain the process of accounting for non-profits and charities. The guide will help you create financial statements that meet generally accepted accounting principles.

Charity and Non-profit Bookkeeping: An Overview

Charity and other non-profit organizations must set up a standard process for bookkeeping and accounting. It is important to record all the financial transactions. You must create a financial statement using any of the options below.

- Create entries in a Physical Ledger

- Enter financial information in the Excel sheet

- Use an online accounting software for Nonprofit such as Aplos and QuickBooks Enterprise Nonprofit Edition

- Hire a bookkeeping service

Nonprofit accounting involves recording receipts of in-kind contributions and donations. It also involves making entries of capital and operational expenditures. Moreover, nonprofit bookkeeping and accounting involves keeping track of accounts receivable, accounts payables, petty cash transactions, and staff salaries.

Difference between Non-Profit and For-Profit Bookkeeping

Nonprofit accounting generally focuses on the accountability of financial resources. It is different than a for-profit organization that focuses on the profitability of the business. Donors and grant providers want to ensure that the funds are utilized appropriately. They want to make sure that the donations are utilized in achieving the goal of the non-profit organization.

Nonprofit organizations employ fund accounting which is different than the accounting system used by for-profit organizations. Fund accounting involves allocating cash to different groups that support the mission of the company.

In contrast to for-profit organizations, non-profit firms separate funds into the following three types of funds.

- Restricted Funds – Funds are allocated to specific projects of the organization

- Unrestricted Funds – Funds can be spent without any restrictions on necessary activities

- Temporarily Restricted – Funds are restricted on certain activities until a specific period

Categorizing the funds into different groups ensures that the non-profit remains accountable regarding the use of funds received by the organization.

Yet another distinct feature of non-profit accounting is the non-distribution constraint. Contrary to for-profits, non-profit organizations are not allowed to distribute earnings to leaders of the organization.

Let’s suppose that The Good Samaritan Shelter had $20,000 in excess funds during a particular period. The directors of the charity organization are not allowed to distribute the funds among themselves. The extra fund will have to be reinvested in the business to meet the mission of the organization.

Nonprofit Accounting Principles

Nonprofit firms must have to adhere to certain guidelines when preparing financial statements. The firms’ financial statements must be prepared as per the generally accepted accounting principles (GAAP).

The Financial Accounting Standards Board (FASB) in the US created the GAAP standards to ensure organizations create uniform financial statements. As per the standards, nonprofit firms prepare the following accounting statements to explain the sources and uses of funds.

Nonprofit Fund Statement

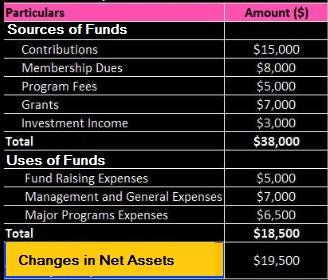

The fund statement of a nonprofit organization consists of the following sections.

Sources of Funds

The expected sources of fund section show the donations and grants expected during the year. The funding sources can be calculated using the direct method or the cut-off method.

Direct Method – The direct method of accounting involves projecting the total sources of the fund during a period. As an example, suppose donors pledge to give you a total of $60,000 during a year. But you expect that you will receive around 50 percent of the pledged fund. In this case, you multiply the pledged amount by a factor of 0.5 i.e. $30,000

Cut-off Method – The method involves breaking down sources of funds from donors and assigning probabilities of receiving the amount from each donor. So, suppose donor A pledged to give $30,000 while donor B pledged to give $30,000. You expect that you will receive 80 percent from donor A and 30 percent from donor B. In this scenario, you should multiply donation A by a factor of 0.8 and donation B by a factor of 0.3. This means you expect to receive $24,000 from donor A and $9000 from donor B.

Uses of Funds

The expected uses of the fund include expenditures that a nonprofit firm expects to incur during a period. The expenses that a nonprofit or charity firm can incur include but are not limited to the following.

- Administrative expenses

- Project expenses

- Fundraising expenses

The fund statement is prepared for donors, the executive management team, and other stakeholders including the general public who might be interested in knowing about the sources and uses of funds. Deducting sources of funds from uses of the fund reflects the addition or reduction in the working capital of the nonprofit organization.

The following image shows the sections of the fund statement of a nonprofit or charity firm.

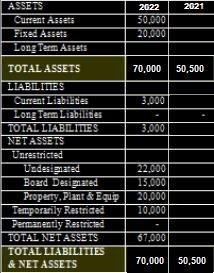

Nonprofit Statement of Financial Position

A nonprofit statement of financial position is the balance sheet of a non-profit organization. The accounting document reflects the financial position of a nonprofit organization during a period.

The statement of financial position shows the list of assets and liabilities of the organization. The sections are similar to the assets and liabilities shown on the Balance Sheet of a for-profit organization. But unlike the balance sheet of the for-profit firm, the statement of financial position of a non-profit does contain the capital section.

In addition, the statement of financial position contains the section ‘accumulated fund’ instead of ‘retained earnings. The sections of the statement of financial position can be summarized by the following equation.

Net Assets = Assets – Liabilities

The assets section consists of the long-term and short-term assets. Similarly, the liabilities section consists of current and long-term liabilities.

The following image shows the sections of the statement of financial position of a nonprofit or charity firm.

The statement of financial position shows that the total liabilities and net assets have increased as compared to the previous period.

By looking at the different sections of the statement of financial position, the readers will know about the financial health of a nonprofit firm. An increase in assets represents that a nonprofit firm is doing exceptionally well. In contrast, a decrease in assets means that the firm is not in a good financial position.

Nonprofit Budget

A nonprofit budget is prepared using historical spending habits. The budget is used to predict expenses to ensure the optimal allocation of resources. It contains the details of expenses and revenue of the organization during a year.

Your nonprofit’s statement of functional expense breaks down your expenditures into various common categories, providing a “function” for each expense. This categorization will separate expenses into one of three operational functions: program expenses, administrative expenses, or fundraising activity expenses.

Conclusions

Accounting for non-profits can be made easy help of professional outsourced bookkeeping services. You should hire professionals who have a thorough understanding of recording sources and uses of funds as per the generally accepted accounting principles.

Maxim Liberty provides affordable bookkeeping services in the US. Our team of professional CPAs has decades of experience in bookkeeping in line with state and federal legislation. Contact us by dialing (703) 957-6938 today.