Outsourced Bookkeeping: Your Ultimate Guide

Outsourced Bookkeeping for Businesses

Outsourced bookkeeping is a smart solution for small businesses looking to manage their finances without the high costs and time commitments of handling it in-house. By outsourcing, you gain access to expert bookkeeping services, save money, and enjoy greater flexibility. In this guide, we’ll cover what outsourced bookkeeping entails, its key advantages, how to select the right service provider, and essential tips for building a successful partnership.

Table of Contents

- What is Outsourced Bookkeeping?

- Why Outsource Bookkeeping?

- When Should You Consider Outsourcing Bookkeeping?

- How to Choose the Right Outsourced Bookkeeping Provider

- Options to Consider: Comparing Your Bookkeeping Choices

- How to Transition from In-House to Outsourced Bookkeeping

- How Does Outsourced Bookkeeping Work?

- Outsourced Bookkeeping Case Studies

- Frequently Asked Questions

- Conclusion

What is Outsourced Bookkeeping?

Outsourced bookkeeping involves hiring an external provider to manage your financial records, from transactions to financial reporting. This service lets businesses access expert financial management without the full-time cost of in-house staff. Financial tasks that you can outsource include the following.

- Recording transactions: Ensuring that sales, purchases, and payments are accurately documented.

- Managing accounts payable: Keeping track of outgoing bills.

- Managing accounts receivable: Keeping track of incoming payments.

- Processing payroll: Handling employee wages, deductions, and tax obligations.

- Generating financial reports: Producing key documents like income statements, balance sheets, and cash flow reports.

- Preparing taxes: Ensuring compliance with tax laws and accurate filing.

Why Outsource Bookkeeping?

Outsourcing bookkeeping offers many advantages. Here are six reasons why it can help your business.

1. Save Time for Core Business

Bookkeeping can be time-consuming. By outsourcing, business owners can focus on growth and core activities. A QuickBooks study found that 67% of small business owners who outsource bookkeeping say it frees up time for essential tasks.

2. Cut Costs

Outsourcing cuts the need for full-time staff, saving on salaries, benefits, and office costs. This approach can save 30-50% compared to in-house teams. Learn more about bookkeeping costs for in-house and outsourced services.

3. Access to Experts

Outsourced firms provide experienced bookkeepers with specialized knowledge. Many also have CPAs on staff for additional expertise.

4. Scalability and Flexibility

Outsourcing allows businesses to adjust service levels as needs change, making it easy to scale up or down.

5. Increased Accuracy and Lower Risk

Outsourced bookkeeping reduces errors with industry-standard practices, which helps improve financial accuracy and reduces compliance risk.

6. Real-Time Financial Data Access

Cloud-based bookkeeping tools allow real-time access to financial records. Platforms like QuickBooks Online, Xero, Wave, Sage, and Zoho enable easy report access, supporting better financial planning.

When Should You Consider Outsourcing Bookkeeping?

Outsourcing bookkeeping is a smart choice in these situations:

- High Turnover or Staffing Issues

If in-house bookkeepers keep leaving or it’s hard to find qualified staff, outsourcing offers stability. Providers have steady teams, so turnover isn’t a problem. - Need for Skilled Bookkeepers Within Budget

Qualified bookkeepers often ask for high salaries. Outsourcing gives you qualified bookkeepers at affordable rates, saving on hiring and training costs. - Flexible Needs Without a Full-Time Hire

If your bookkeeping needs don’t require a full-time role, outsourcing lets you pay only for what you need, with no long-term commitment. - Overworked Staff

If your team is overwhelmed with bookkeeping tasks, outsourcing can help. This lets them focus on more important work. - High Bookkeeping Costs

Outsourcing can reduce expenses compared to in-house teams. If your bookkeeping costs are too high, it might be time to outsource. See typical hourly rates here. - High Software Licensing Fees

QuickBooks and other software licenses can add up. Many outsourced providers include software in their services, saving you extra fees. - Immediate Need for Extra Help

If you have an unexpected workload, outsourcing can provide fast support without the delay of hiring.

How to Choose the Right Outsourced Bookkeeping Provider

Selecting a bookkeeping provider involves considering specific business needs, relevant expertise, and service structure. Here’s a guide to help in making an informed choice:

1. Define Bookkeeping Requirements

Identify whether the business requires basic transaction tracking or comprehensive services like payroll and tax preparation. Defining needs helps narrow down providers with the right service range.

2. Seek Relevant Industry Experience

Consider providers with expertise in your sector. For example, property management bookkeeping solutions are tailored for rental-focused businesses.

3. Check Familiarity with Key Tools

Verify that providers are proficient with tools used in your industry, such as QuickBooks or Sage, which improve efficiency through automation and real-time access to data.

4. Evaluate Communication and Consistency

Determine whether a dedicated bookkeeper is assigned or if services are team-based. Consistent contact fosters continuity and better communication.

5. Review Pricing and Contract Terms

Consider pricing models and transparency. For an understanding of typical hourly rates, refer to the bookkeeper hourly rates page.

Options to Consider: Comparing Your Bookkeeping Choices

Let’s compare different bookkeeping approaches:

1. Do It Yourself (DIY)

DIY bookkeeping is best for very small businesses. It requires bookkeeping knowledge and time but is the most cost-effective option upfront.

2. Hire an In-House Bookkeeper

An in-house bookkeeper provides control and immediate access, but it’s also the most expensive due to salaries, benefits, and overhead costs. Check out our bookkeeping costs comparison to explore part-time and full-time costs.

3. Local Bookkeeping Firms

Local firms offer face-to-face service, which some businesses prefer, but they can be costly and may lack scalability.

4. Accountants Providing Bookkeeping

An accountant offering bookkeeping may be convenient, but it usually costs more than dedicated bookkeeping services.

5. Professional Virtual Bookkeeping Firms

These firms provide cost-effective, scalable solutions for any size business. They leverage technology to streamline operations and often support multiple industries.

How to Transition from In-House to Outsourced Bookkeeping

Here’s how to make a seamless transition:

1. Assess Current Systems

Evaluate your existing system and identify your specific needs.

2. Establish Clear Communication

Define expectations with your provider on reporting frequency, deadlines, and access to records.

3. Share Access to Financial Data

Organize and securely transfer access to your provider.

4. Monitor the Onboarding Process

Stay involved initially to ensure the provider aligns with your expectations.

How Does Outsourced Bookkeeping Work?

Once you hire an outsourced provider, here’s how the process generally unfolds:

1. Initial Assessment and Customization

The provider evaluates your financial needs and develops a tailored plan.

2. Transaction Management and Reconciliation

They enter transactions and reconcile accounts regularly, ensuring accuracy in all records. For an in-depth look at reconciliation, explore our bank reconciliation services.

3. Financial Reporting

Regular reports like balance sheets and income statements give you insights into your financial health.

4. Year-End Support

The provider assists with tax preparation by organizing year-end reports and ensuring compliance.

Outsourced bookkeeping offers flexibility in how your bookkeeper accesses and updates your financial records. There are three primary ways an outsourced bookkeeper can work with your QuickBooks or other bookkeeping data: using their local desktop, accessing a remote desktop, or using QuickBooks Online (QBO). Let’s explore these options in detail.

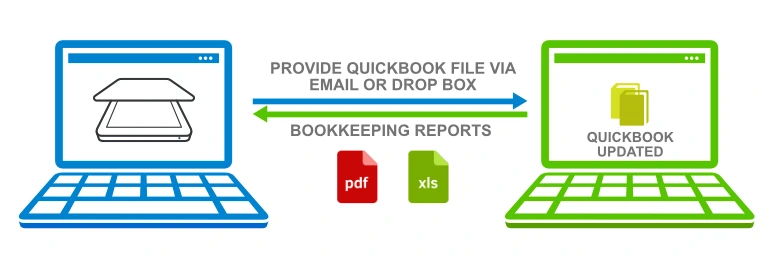

1. Local Desktop Option – QuickBooks Running on Bookkeeper’s Computer

In this setup, the bookkeeping provider works on QuickBooks installed on their local computer. Businesses can either start with a new QuickBooks file or transfer an existing one.

- Initial Setup: To transfer an existing file, clients can save the QuickBooks file in QBM format and upload it to a shared folder, such as Dropbox.

- Document Sharing: Businesses can share relevant documents for data entry via email, Dropbox, or through downloads from websites.

- Updates: The bookkeeper updates the local QuickBooks file, and clients receive financial reports in Excel or PDF format via email.

- Backup: The QuickBooks file is regularly backed up in QBM format to the shared folder after major updates.

Pros:

- No need to purchase additional QuickBooks licenses, as the bookkeeper uses their own.

- The service provider maintains the software and ensures that clients receive accurate reports.

- Works efficiently for large volumes of data entry.

- In case of service termination, all data is saved on Dropbox and remains accessible to the client.

Cons:

- Since QuickBooks runs locally on the bookkeeper’s computer, only the provider can make changes to the file.

- Clients without QuickBooks can only view, but not modify, backup data.

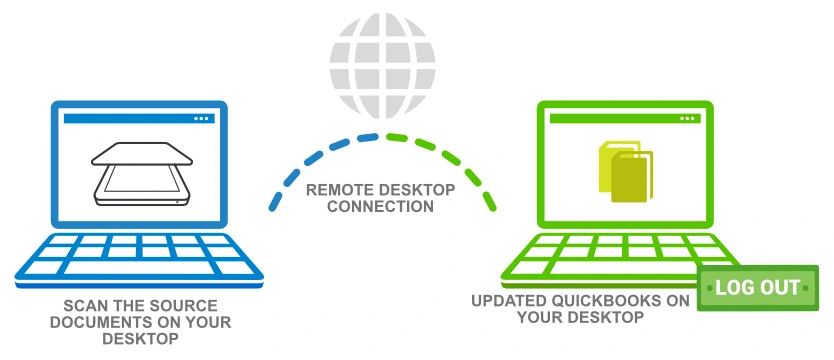

2. Remote Access Option – QuickBooks Running on Client’s Computer

For businesses that prefer to maintain control of their QuickBooks software, the bookkeeper can remotely access QuickBooks running on the client’s computer using remote desktop software.

- Initial Setup: The bookkeeper can either create a new QuickBooks file or use the client’s existing file stored on a remote desktop.

- Document Sharing: Clients can share documents via email, Dropbox, or by saving files directly on the remote desktop.

- Updates: The bookkeeper connects to the remote desktop over the internet to update the QuickBooks file in real time.

- Backup: After each significant update, the file is backed up to the shared Dropbox folder.

Pros:

- Both the business and the bookkeeper can work on the same QuickBooks file, providing real-time updates and collaboration.

- Client can watch over the bookkeeper’s actual work and see everything the bookkeeper does on their computers.

- Clients can run their own reports and view changes made by the bookkeeper.

- If services are terminated, all data remains stored on the client’s machine and Dropbox.

Cons:

- Hosting QuickBooks on a dedicated computer can increase costs (around $500 for a new machine).

- Additional QuickBooks licenses and remote access software may be required, which can add up to $200 every few years and $10 per month, respectively.

- Can be slower for large data entry tasks.

3. Online Option – QuickBooks Online (QBO)

QuickBooks Online provides the most flexibility, allowing both the client and the outsourced bookkeeper to access and update financial data from anywhere with an internet connection.

- Initial Setup: Clients can either start a new QBO account or transfer an existing QuickBooks Desktop file to QBO.

- Document Sharing: Documents can be shared via email, Dropbox, or downloaded from other platforms.

- Updates: The bookkeeper is invited to the QBO account and can make updates online.

- Backup: The file is backed up regularly by the software provider.

Pros:

- Both parties can access and update the same QBO account simultaneously, ensuring real-time collaboration.

- QuickBooks Online is accessible from any device, including mobile phones and tablets.

- QBO is continuously updated with the latest features, making it a forward-looking solution for financial management.

- Even if services are discontinued, all financial information remains in the client’s QBO account and Dropbox.

Cons:

- While QBO starts at $25 per month, costs can increase to $180 per month as more features and users are added.

- QBO lacks certain advanced features still available in QuickBooks Desktop.

- The system can be slow when handling large data entries.

- QBO relies heavily on a stable internet connection.

Outsourced Bookkeeping Case Studies

Case Study 1: Startup Success with Outsourced Bookkeeping

A fast-growing tech startup outsourced its bookkeeping after struggling with in-house financial management. By partnering with an external provider, they reduced bookkeeping costs by 40% and were able to focus on securing additional funding. The startup’s financial health improved drastically as the provider implemented automated reporting tools, giving the leadership team real-time insights into cash flow and profitability.

Case Study 2: Retail Business Growth

A retail chain with multiple locations outsourced its bookkeeping to handle increased financial complexity. By scaling up bookkeeping services during the holiday season and scaling down during slower months, the business maintained accurate financial records without overstaffing. This flexible approach resulted in a 25% increase in operational efficiency and allowed the business to focus on customer service and inventory management.

Frequently Asked Questions

Q: How can I monitor outsourced bookkeeping work?

A: Most bookkeeping systems include audit logs that track when a bookkeeper logs in and logs out. While some tasks are done outside the system, these logs provide insight into active work hours.

Q: How secure is outsourced bookkeeping?

A: Security is customizable. You can restrict a bookkeeper’s access, like limiting permissions to view financials without payment authorization. This setup helps keep sensitive data protected.

Q: How do I get started with outsourced bookkeeping?

A: Starting is simple. You’ll typically provide initial documents like bank statements, access to your bookkeeping software, and specific guidelines for the services you need. Most providers will guide you through the setup.

Q: Will I have direct communication with my bookkeeper?

A: Yes, most providers offer direct access to your assigned bookkeeper through email, phone, or video calls. Regular check-ins and updates keep you informed.

Q: Can I outsource just part of my bookkeeping?

A: Absolutely. You can choose specific tasks to outsource, such as payroll or bank reconciliations, while keeping other tasks in-house.

Q: How do outsourced bookkeepers ensure accuracy?

A: Outsourced bookkeepers follow strict practices and use software with automated checks. They also perform regular reviews and reconciliations to minimize errors and maintain accuracy.

Q: What happens if my business grows? Can outsourced services scale with it?

A: Yes, outsourced services are highly scalable. You can easily adjust the level of service to match your business’s changing needs, whether you need more support or less.

Q: Do outsourced bookkeepers handle tax preparation?

A: Many outsourced bookkeepers offer tax preparation services or can work with your CPA to make tax season easier, ensuring your books are accurate and tax-ready.

Q: How quickly can an outsourced bookkeeper start working?

A: Most providers can start within days once initial documents and software access are set up. This quick onboarding makes outsourcing a flexible solution, especially when immediate support is needed.

Q: Is outsourced bookkeeping right for small businesses?

A: Yes, small businesses benefit significantly from outsourced bookkeeping. It provides affordable access to professional financial management without hiring full-time staff, helping small business owners focus on growth.

Q: Can I continue using my current bookkeeping software?

A: Yes, most providers work with common platforms like QuickBooks, Xero, and Zoho Books. They can integrate into your existing system, ensuring a smooth transition and continuity.

Q: How often will my books be updated?

A: The update frequency depends on your needs. Many providers offer daily, weekly, or monthly updates to keep your financials accurate and current.

Q: Will I lose control over my financials if I outsource?

A: No, you retain full control. Outsourced bookkeeping services are designed to give you access to real-time data and reports, allowing you to monitor your finances closely.

Q: Are there any hidden fees with outsourced bookkeeping?

A: Reputable providers operate transparently, disclosing all fees upfront. Be sure to ask for a full cost breakdown to avoid unexpected charges.

Q: What if I’m unhappy with the service?

A: Most providers offer flexible, no-commitment plans. If you’re unsatisfied, you can typically cancel without long-term contracts or penalties.

Conclusion: Empower Your Business with Outsourced Bookkeeping

Outsourced bookkeeping provides professional, scalable financial management, freeing you to focus on growing your business. With the right provider, you can save time, reduce costs, and gain valuable insights. Learn more about our comprehensive bookkeeping services and how they can benefit your business.

Why Choose Us for Outsourcing?

There are numerous bookkeeping providers to choose from. How can compare us the best bookkeeping services? When you decide to outsource your bookkeeping, here’s why we stand out from the rest.

1. High-Quality Bookkeeping

With over 17 years of experience, we’ve been focused exclusively on bookkeeping since 2005. We don’t lock you into proprietary software, but instead, work with popular tools like Intuit QuickBooks, Xero, Wave and Sage. Our best practices ensure that your books are clean and accurate.

2. Focus on Bookkeeping

Our teams are experts in outsourced bookkeeping and work with thousands of clients, including CPAs and businesses. Unlike in-house bookkeepers, who handle multiple tasks, we focus 100% on managing your books.

3. QuickBooks Expertise

We specialize in QuickBooks bookkeeping—both Desktop and Online versions—so you can trust us to handle all aspects of your financial management.

4. Daily Updates

We can update your books daily or as often as you need. You’ll always have up-to-date financial information without the hassle of managing it yourself.

5. Built-In Supervision

All our plans include a supervisor who reviews the quality of your books before they’re delivered to you. This extra layer of oversight ensures that your financial data is accurate and complete.

6. Best Practices

We serve thousands of clients across various industries, so we can apply the best practices for your specific needs, ensuring your books are managed efficiently.

7. Save Money and Improve Cash Flow

Outsourcing your bookkeeping can save you significant money. Our rates are lower than in-house solutions, starting at $7.50 per hour. By outsourcing, you only pay for the hours you need. Our flexible plans start at just $50 per month, offering you cost-effective solutions.

Beyond cost savings, outsourcing helps you manage cash flow more effectively. Our expert bookkeepers track your financials to help you avoid cash flow issues and improve overall financial health.

8. Free Up Time for What Matters

By outsourcing your bookkeeping, you free up valuable time to focus on your business and your family. Let us handle the tax prep, work with your CPA, and ensure your books are ready for tax season. Enjoy peace of mind knowing your finances are in good hands.

Maxim Liberty has been providing outsourced bookkeeping services to businesses and accounting firms in the USA and Canada since 2005.