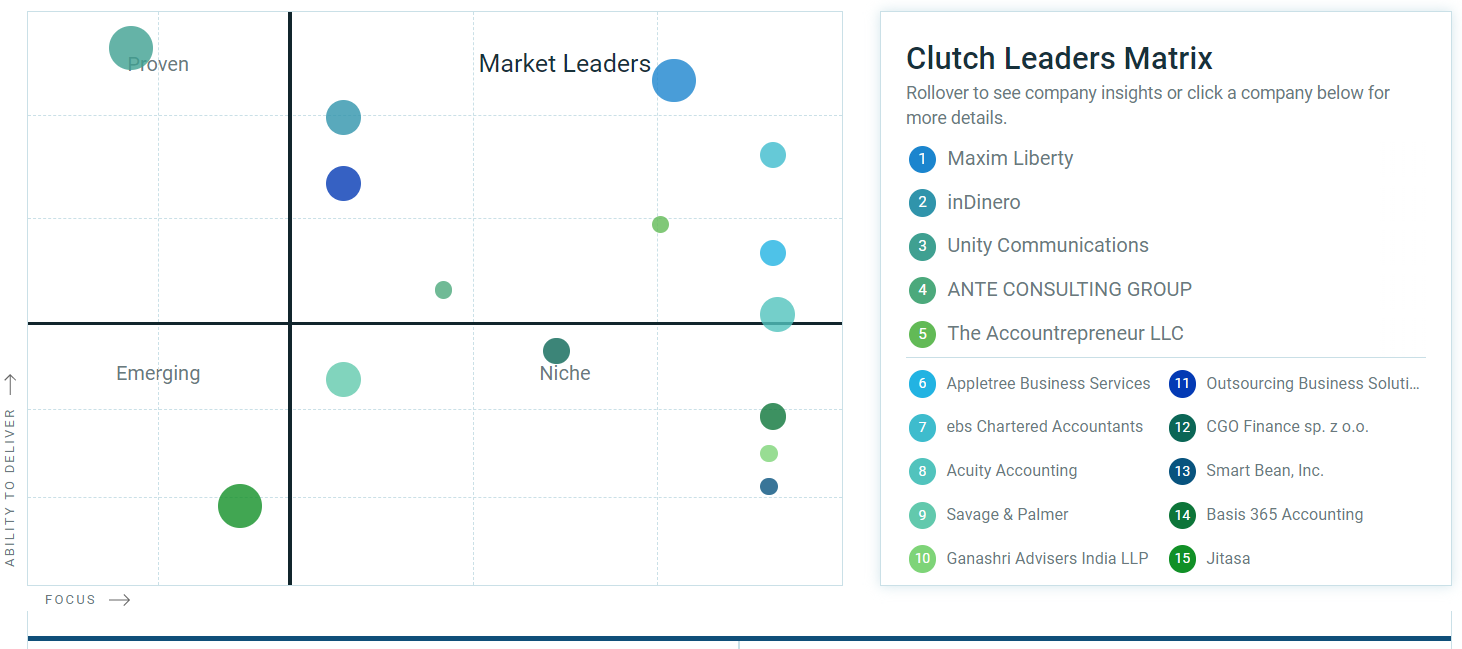

Clutch names Maxim Liberty as the #1 Bookkeeping Service

Maxim Liberty, a pioneering bookkeeping service provider based in San Juan, PR, has recently received the prestigious #1 ranking on…

Maxim Liberty Celebrates 18-Year Anniversary

18 years focused on bookkeeping Maxim Liberty, a leading bookkeeping service provider, is proud to celebrate its 18-year anniversary. Since…

FTC Safeguards Rule for Accounting & Bookkeeping

Outsourcing bookkeeping to a professional bookkeeping service provider can help small businesses save time and resources while ensuring that their…

What is an Accounts Receivable Aging Report?

What is an A/R Aging Report? Accounts Receivable (A/R) aging report is a financial management tool that tracks outstanding customer…

What is an Accounts Payable Aging Report?

What is an A/P Aging Report? An A/P aging report is a financial document that shows the outstanding invoices or…

What is a Credit Memo?

Credit Memos: What They Are and How to Use Them If you’re a business owner or a bookkeeper, you’ve probably…

How do you setup class tracking in QuickBooks?

When it comes to organizing business information, QuickBooks is a popular accounting software that provides efficient tools to help users…

Common Bookkeeping Challenges For Real Estate Businesses: Tips For Overcoming Them

For Real Estate businesses, Bookkeeping is an important part of running a successful operation. While it may seem straightforward, there…

Tips For Avoiding Common Bookkeeping Mistakes In Law Firms

Running a successful law firm involves a lot more than just providing legal services. You also have to manage the…

At what age should you start collecting social security – 62 or 70?

The decision to collect Social Security benefits is a complex one and depends on a variety of factors, including your…